#How to enter expenses in quickbooks with reminder software

The both are accounting software that make small business function better. The functionality of FreshBooks proves that it is a better alternative to QuickBooks. Exit window.įreshBooks- A Better Alternative to QuickBooks In applicable fields, enter payee name and amountĪssign the loan repayment interest elementĬhoose ‘Edit’ button, select ‘Memorize Check ’ option to enter payment at regular intervals automatically and issue a payment reminder In the applicable fields, enter a name as well as reference number. Click the down-arrow button so that you can expand the account types availableĬhoose ‘Other Current Liability’ which suits short-term loans repayable in a period of over 1 year or less.Ĭhoose ’Long-term liability’ for long-term loans. From context menu select ‘New’.įrom accounts list, select ‘Other’. Proceed to ‘Lists’ and then ‘Charts of Accounts’

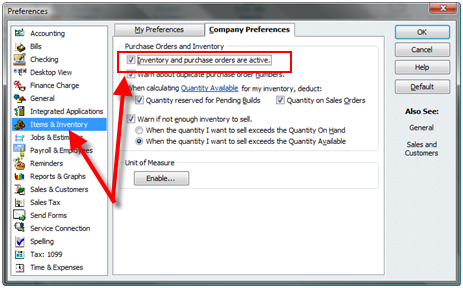

From pull-down menu, select ‘New’Ĭhoose ‘Company’. In the top menu, click ‘Lists’ tab then in context menu ‘Chart of Accounts’Ĭhoose ‘Account’ button below. The following is an alternative procedure to enter a loan and record a loan receivable in QuickBooks: However, what happens if QuickBooks loan manager is not working? How do you enter a loan or record a loan receivable in QuickBooks? QuickBooks works with QuickBooks loan manager since it calculates payment schedules and interest. It enables you to track any loan deposit money as well as all loan payments. This borrowed funds become QuickBooks loans when you use QuickBooks to set up the liability account for this recording. This enable you track all loan payments made as you reduce the liability. Therefore, as soon as you borrow money for your firm, it is advisable to record this loan as a liability in your company accounts. It is very usual for any business to borrow funds now and then, especially for capital investments like equipment, new premises, development and product research. This article is helpful to you since it will educate you on keeping track of loans as you pay with time.

It will enlighten you on the purpose of QuickBooks loan manager and an alternative procedure in case it is not working. This article is quite educative on matters concerning QuickBooks loans.

0 kommentar(er)

0 kommentar(er)